INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- MoD initiates comprehensive review of Defence Acquisition Procedure 2020, pushes for defence reforms

- G7: The Swansong

- Kalinga Connect: South Asia to Polynesia

- Advanced MRSAM for India for a greater firepower

- Must Credit DRDO for Operation Sindoor, now what is next for defence R&D?

- Operation Sindoor | Day 2 DGMOs Briefing

- Operation Sindoor: Resolute yet Restrained

DEFENCE BUDGET / ANALYSIS

Defence Budget 2024-25 — An Analysis

The defence budget for Financial Year 2024-25 maintains key trends of the past decade, including attempts to enhance capital expenditure, indigenisation efforts, and strengthening border infrastructure, though challenges remain in modernising the Armed Forces due to a modest overall budget increase

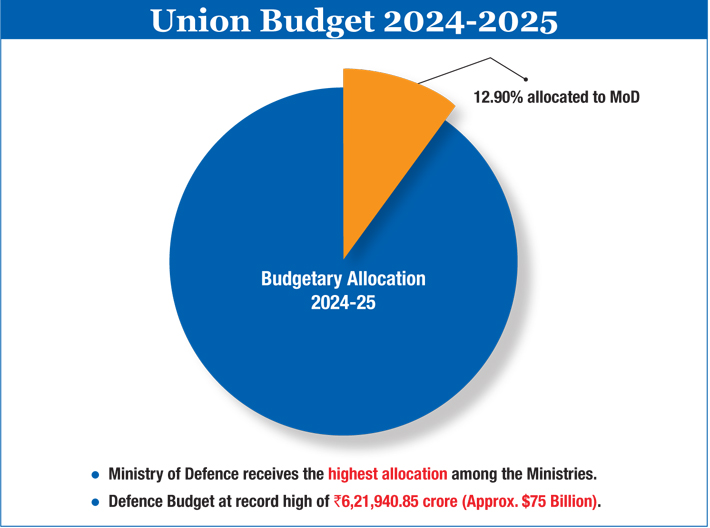

India’s interim budget for Financial Year (FY) 2024-25 was tabled by the Finance Minister on February 1, 2024. Consequent to the election of the new government, the final budget for the current financial year (CFY) was tabled in the Parliament on July 23, 2024. The final budget is not very dissimilar to the interim budget in terms of overall budgetary figures, though there are a few differences. The total defence budget (including defence pensions) for FY 2024-25 is ₹6,21,940.85 crore (approximately $75 billion) as against ₹6,21,540.85 crore in the interim budget. The amount allocated to defence is 4.79 per cent higher than the Budget Estimates (BE) for FY 2023-24, but marginally lower by 0.37 per cent than last year’s Revised Estimates (RE). Defence continues to receive the highest allocation amongst all ministries in the Government of India, comprising 12.9 per cent of government expenditure and amounting to 1.89 per cent of GDP. However, if Defence Pensions are excluded, the actual percentage of GDP spent on Defence reduces to around 1.4 per cent.

Defence allocation is accounted for under four demands for grants:

- Demand No 19 – Ministry of Defence (Civil);

- Demand No 20 – Defence Services (Revenue);

- Demand No 21 – Capital outlay on Defence Services; and

- Demand No 22 – Defence Pensions.

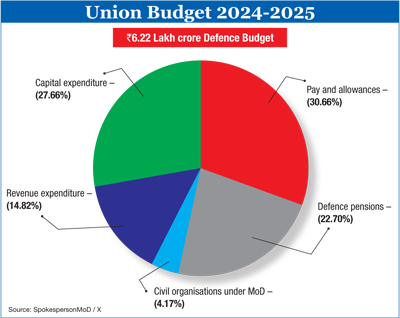

The share of Capital expenditure in the budget is 27.66 per cent; Revenue expenditure on sustenance and operational readiness comprises 14.82 per cent; Pay and Allowances comprises 30.66 per cent; Defence Pensions 22.70 per cent; and Civil Organisations under the MoD 4.17 per cent. It is evident that the defence budget is weighed heavily in favour of Revenue expenditure, with over 50 per cent of the allocation going towards pay and allowances. A new measure introduced in the budget is the consolidation of procurements by the three Services under common heads such as aircraft, aero engines, heavy and medium vehicles, etc. to foster jointness and flexibility in budget management.

The total defence budget for FY 2024-25 is ₹6,21,940.85 crore (approximately $75 billion), marking a 4.79 per cent increase over the previous year’s Budget Estimates (BE)

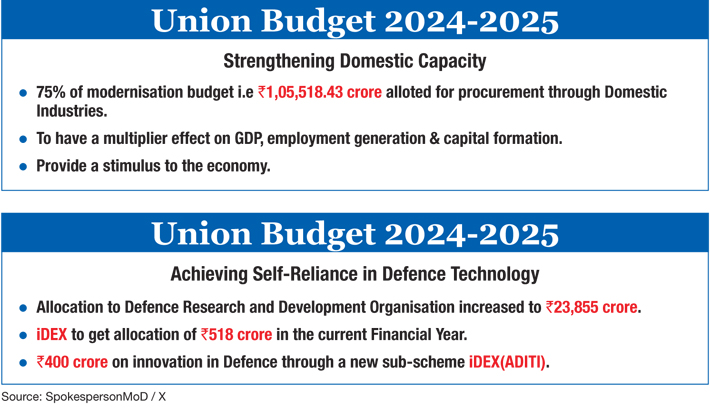

Capital Outlay. Modernisation of military forces is primarily driven by the capital outlay within each year’s budget. The budgetary allocation towards capital expenditure for this year is $20.60 billion (₹1,72,000 crore) and is 9.40 per cent more than RE for 2023-24 and 5.78 per cent higher than the BE for 2023-24 – a modest increase if the year-onyear inflation is factored. 75 per cent of the modernisation outlay (₹1,05,518.43 crore) is reserved for procurement through domestic industries in the current financial year. A closer examination of capital expenditure shows an increase of 42 per cent and 15 per cent for aircraft and aero-engines and heavy and medium vehicles over 2023-24 (BE) respectively. The 42 per cent increase in aircraft and aero-engine allocation suggests upcoming acquisitions of platforms like MQ-9B UAS, GE-404/414 engines, Light Combat Helicopter (LCH), C295 transport aircraft and additional Su-30s, besides modernisation of the Su-30 fleet, engine upgrade for MiG-29s, and funding of the LCA MK–I IOC/FOC configuration. The allocation for Naval Fleet is ₹23,800 crore for 2024-25 (BE), a decrease of 1.7 per cent over 2023-24 (BE). Major Capital acquisitions planned for the Indian Navy (IN) include deck-based fighter aircraft, submarines, next-generation survey vessels, missile vessels, tankers, etc. No major capital acquisitions for the Indian Army have been mentioned in the press note, which indicates that these might be relatively smaller procurements. MoD’s firm trust in public enterprises is demonstrated by its commitment to invest ₹4,748 crore, which is a 7 per cent increase over 2023-24 (BE).

Revenue Outlay. The budgetary allocation towards Revenue expenditure for this year is $33.86 billion (₹2,82,773 crore), an increase of 4.68 per cent over the 2023-24 (BE). Of this, ₹92,088 crores have been earmarked for sustenance and operational readiness, which is 48 per cent higher than the allocation for FY 2022-23, and is a welcome step. Allocation of revenue expenditure for stores, works, repairs and refits for this year is ₹69,571.4 crore for 2024-25 (BE), which is a decline of 0.5 per cent over 2023-24(BE) and a substantial decline of over 2023-24(RE). The allocation towards works has decreased for all the three services, though this could be due to excessive existing sanctions on which work is still in progress. There is a substantial increase of 30 per cent in allocation towards Border Roads Organisation (BRO) amounting to ₹6,500 crore, to maintain momentum on building-up our border infrastructure.

Defence Pensions and ECHS. The budgetary allowance for defence pensions has gone up to ₹1.41 lakh crore, an increase of only 2.17 per cent over the previous year’s allocation, which if inflation is considered, indicates negative growth under this head. A welcome step has been the unprecedented increase of 28 per cent to the Ex-Servicemen Welfare Scheme (ECHS), which will ensure the clearing of pending bills, and the decision to equate ECHS rates with CGHS rates, which will ensure better health care for over 32 lakh retired defence personnel.

Coast Guard. The Indian Coast Guard (ICG) has continued to get a healthy increase in budgetary support with ₹7,651.80 crore, the outlay for 2024-25 being 6.31 per cent higher than the previous year’s allocation. The Capital to Revenue ratio of the ICG remains very healthy, with ₹3,500 crore from the total allocation of ₹7,651.80 crore being for Capital expenditure and the rest being allocated for Revenue expenditure.

Amendments to Customs Act. A major step has been amendments to the Customs Act with effect from July 24, 2024, under which the rate of Basic Customs Duty (BCD) has been reduced to zero on the following items:

- Components and consumables for use in the manufacture of specified vessels.

- Technical documentation and spare parts for construction of warships.

- To boost the processing and refining of critical minerals such as lithium, copper and cobalt, which are critical for space and defence sectors, and help secure their availability for domestic manufacturing, it has been proposed to fully exempt customs duties on 25 critical minerals and reduce BCD on two of them.

- To promote domestic MRO, duration for export in case of aircraft and vessels imported for maintenance, repair and overhauling has been increased from six months to one year, which shall be further extendable by one year. Currently, articles of foreign origin can be imported into India for repairs subject to their re-exportation within six months extendable to one year.

- Further, the period for duty-free re-import of goods (other than those under export promotion schemes), which had been exported out from India, for repairs under warranty has been increased from three years to five years, which shall be further extendable by two years.

- Nil BCD on import of components and consumables for manufacturing of specified vessels and on technical documentation and spare parts, which is a welcome move to promote domestic manufacturing of warships.

Allocation to Indigenisation. The continuing commitment to Atmanirbhar Bharat is demonstrated by the fact that assistance for prototype development under ‘Make’ Procedure has increased by 46 per cent over 2023-24 (BE). This could be towards projects such as High-Altitude Pseudo Satellite, Long Range Land Attack Cruise Missile, Hypersonic Glide Vehicle, Directed Energy Weapons (300 KW and more), Light Weight Tank, Communication System, among others. The budgetary allocation for iDEX under the ‘Acing Development of Innovative Technologies (ADITI)’ scheme has been enhanced from ₹115 crore to ₹518 crore to promote innovation. The iDEX (ADITI) scheme with 17 challenges has seen an overwhelming response from the Indian Industry. Through this scheme, MoD is engaging with startups/MSMEs and innovators to develop defence technology solutions for the Indian Armed Forces. A grant of up to 50 per cent of the product development budget with a maximum limit of ₹25 crore will be awarded to successful innovators under this scheme.

DRDO Outlay. The budgetary allocation to the DRDO has remained almost static at ₹23,855 crore, of which ₹13,208 crore has been allocated for capital expenditure, which is an increase of 2.8 per cent over 2023-24(BE). ₹60 crore has been allocated for the Technology Development Fund (TDF), which is specially designed for new startups, MSMEs and academia to work with the DRDO.

Funding for ‘Deep Tech’. The PIB note of February 1, 2024 had indicated that a corpus of ₹one lakh crore – a huge sum by any account – has been earmarked for ‘Deep Tech’ to provide long term loans to tech savvy youth and companies and tax advantage to start-ups to give impetus to innovation in the defence sector. While a welcome step to encourage indigenous defence technologies, it is not clear whether this corpus would go from the defence budget. The nature of this corpus also implies that funds would be disbursed on ‘as required’ basis. Unless created separately, considering the pace of innovations, it is quite likely that a major part of this corpus could lapse at the end of the current financial year (CFY). However, this allocation is not mentioned in the PIB note of July 23, 2024, announcing the highlights of the final defence budget.

Capital expenditure for defence modernisation in FY 2024-25 is ₹1,72,000 crore, with 75 per cent of the outlay reserved for procurement through domestic industries

Macro Trends in Defence Budget. The defence budget for the CFY maintains the macro trends of defence budgets over the past decade (2014-24). These include attempts to enhance capital expenditure and reduce revenue expenditure; emphasis on indigenisation (Atmanirbharta); provision of additional Revenue funds for making good critical capability shortfalls; strengthening of border infrastructure, especially roads on our northern border; and greater funding for indigenisation. There has been an average annual increase of about 8 per cent in the defence budget in the period 2014-24, though the increase in real terms has eroded considerably due to an average inflation of about 5 per cent (and a peak of 8 per cent) during the same period. Significantly, there has been a steady drop in the percentage of national spending on defence from about 20 per cent in 2014-15 to 12.9 per cent in 2024-25, which is an indicator of the Indian economy’s growing strength. The percentage of GDP spent on defence expenditure during the period has been consistently under 2 per cent, with an average annual expenditure of about 1.8 per cent of GDP, though if Defence Pensions are deducted, the outlay reduces to 1.3 per cent of GDP.

The areas of emphasis pursued by the government over the past decade have generally delivered good results. Indigenisation and technology development has received a much-needed impetus, critical capability shortfalls have been significantly reduced and border infrastructure has been enhanced. However, the expected reduction in Revenue expenditure on pensions, pay and allowances, and the expected increase in Capital expenditure have not entirely been realised, in major part because the overall growth in India’s defence budget over the past decade has been modest. This has ensured that the modernisation of the Armed Forces has remained confined to a few select areas, with several critical capability voids yet to be addressed.

Outlay for the Indian Navy (IN)

The IN got the smallest share of the defence budget (18.9 per cent) between the three Services as per the RE for FY 2023-24 and this trend continues for FY 2024-25. The 36th report (2023-24) by the Parliament’s Standing Committee on Defence (SCOD) on the Demands for Grants for FY 2023-24 had stated that in FY 2022-23, the Capital to Revenue ratio of the IN was a healthy 68:32. The report also stated that Acceptance of Necessity (AoN) had been accorded to 35 schemes worth ₹1,20,797.31 crore.

In BE 2023-24, the Capital allocation of the IN was the second highest after the IAF, with ₹52,804.75 crore being allocated. In FY 2024-25, 37 per cent of the overall Capital expenditure outlay for the three Services has been allocated to the IN. An outlay of ₹23,800 crore has been mentioned under the Capital head for ‘Naval Fleet’ and ₹6,380 crore for ‘Dockyard Projects’. It is understood that today the Indian Navy has 66 ships on its order book, including the Fleet Support Ships, Cadet Training Ships, Next Generation OPVs, Next Generation Corvettes, additional Scorpene class submarines, etc. Major AoNs are also being reportedly being processed for two SSNs, the second indigenous aircraft carrier (IAC-2) and Landing Platform Docks. The government recognises the multiplier effect of 1.82 in the ship-building sector, stating that ₹1.5 lakh crore in naval shipbuilding projects would accrue a monetary circulation of ₹2.73 lakh crore. The fact that the multiplier effect of shipbuilding in terms of domestic investment, job growth and technology development has not only been recognised, but also quantified, is a positive indicator in the eventual realisation of key ship-building projects.

Apart from the IAC-2 and the SSN, the IN requires to obtain approval for a range of ships, submarines, aircraft and weapons. Some of the platforms required include the P-75(I) submarines, additional frigates/destroyers, minesweeping/ mine-hunting platforms, additional long range and medium range maritime patrol aircraft, Remotely Piloted Aircraft (RPA), etc, which are at advanced stage of approval through the defence procurement process. If approved during the CFY, these schemes would require additional funding, which currently may not be available. As far as Revenue allocation is concerned, the IN received 11.6 per cent of the Defence Revenue budget, which has shown a modest increase of 1.3 per cent from the previous year. This is in line with Revenue allocations (non-salary) to the IN over the past decade and would appear to be sufficient for meeting the IN’s requirements. As such, additional funds have historically been made available when required for operational commitments.

Conclusion

In the oral evidence provided by the naval representative to the 36th SCOD, the maritime threat perception to India vis-à-vis China’s growing maritime power was clearly brought out. The naval representative also stated that meeting this challenge required sustained funding, as shipbuilding programmes have long gestation periods of 10-15 years. This need was echoed in the SCOD report, noting that expenditure on New Schemes as compared to Committed Liabilities had reduced, indicating that the IN’s modernisation drive was slowing. As is evident from the figures allocated to defence expenditure during the final budget, the increase in defence spending has been modest. Therefore, the fact remains that overall defence expenditure needs to go up if the current imbalance between Revenue and Capital expenditure is to be redressed and modernisation of the Armed Forces is to progress in accordance with the requirements of national defence.