INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- MoD initiates comprehensive review of Defence Acquisition Procedure 2020, pushes for defence reforms

- G7: The Swansong

- Kalinga Connect: South Asia to Polynesia

- Advanced MRSAM for India for a greater firepower

- Must Credit DRDO for Operation Sindoor, now what is next for defence R&D?

- Operation Sindoor | Day 2 DGMOs Briefing

- Operation Sindoor: Resolute yet Restrained

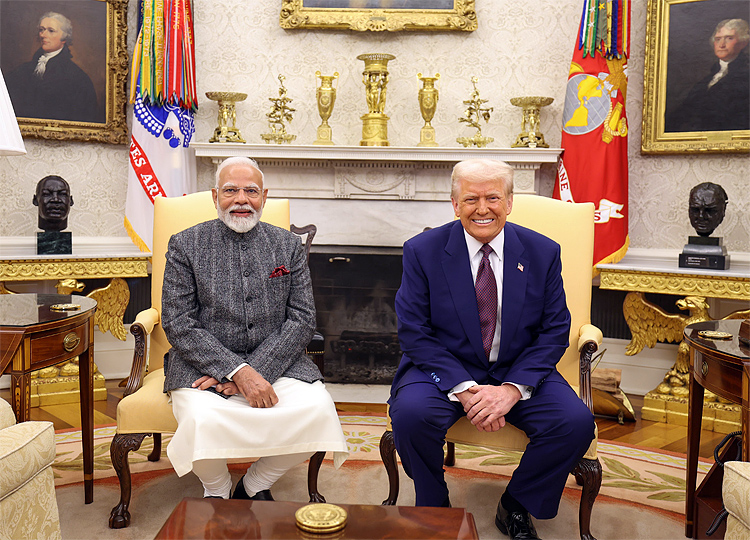

India–US trade deal set to move despite the key differences

India and the US aim to conclude a first-phase interim trade pact before July 8–9, before the paused 26 per cent reciprocal tariffs by US are set to resume. The negotiations are in full swing in the US as President Donald Trump has said he does not plan to extend the deadline any further.

India and the US aim to conclude a first-phase interim trade pact before July 8–9, ahead of the US's paused 26 per cent reciprocal tariffs are set to resume. While the negotiation is in full swing in the US, President Donald Trump has said he does not plan to extend the deadline any further.

On April 2, the US had suspended 26 per cent levies on Indian imports till July 9, which aimed to bridge the trade gap. However, the baseline tariff of 10 per cent remains. While the negotiation is going on, India has sought full exemption from the additional 26 per cent tariff.

While the negotiation is going on, India has sought full exemption from the additional 26 per cent tariff.

This deal serves as a stepping stone toward a sweeping Bilateral Trade Agreement (BTA) by October/November 2025 to support a shared ambition of doubling trade to $500 billion by 2030.

India's merchandise exports to the US rose by 21.78 per cent to $17.25 billion in April-May this fiscal, while imports rose by 25.8 per cent to $8.87 billion.

India's Key Asks & Offers

| Sector | What India Wants | What India's Offering |

|---|---|---|

| All goods | Exemption from the additional 26% tariffs and rollback of the 10% baseline on its exports | Proposed a major cut: slashing its average tariff gap from ~13% to under 4%, including zero duties on ~60% of tariff lines. |

| Labour-intensive exports | Preferential access & reduced duties for textiles, leather, gems & jewellery, shrimp, horticulture. | |

| Sensitive sectors | Red lines on agriculture and dairy, enforced via quotas/MIPs to protect farmers. |

India is also seeking assurances against future US tariffs after the interim deal is signed.

US Demands & India's Concessions

US priorities are to access Indian markets for agricultural exports, including wheat, corn/ethanol, tree nuts, dairy, plus EVs, wine/liquor, automobiles, steel, pharma, medical devices, and petrochemicals.

In response, India has offered reduced duties on select key areas: almonds, pistachios, walnuts, cranberries, bourbon whiskey, LNG, motorcycles, and telecom equipment.

This deal serves as a stepping stone toward a sweeping Bilateral Trade Agreement (BTA) by October/November 2025 to support a shared ambition of doubling trade to $500 billion by 2030.

Additionally, India has also put forth regulatory relief on shrimp and processed foods.

However, the most relaxed tariff is for the automobile with "Zero-for-zero" proposals under exploration for auto parts, textiles, and engineering goods to initiate reciprocal tariff removals.

Challenges for the Trade Deal:

India is resisting broad agricultural market opening, citing political sensitivity and protecting rural livelihoods. It is such a contentious issue that India has never allowed any duty concession to the Agriculture and dairy sectors in any of its free trade pacts. India has not opened up dairy in any of its free trade pacts signed so far.

Apart from agriculture, negotiation challenges have emerged over steel, auto components, and high tariffs on farm goods.

India is also seeking assurances against future US tariffs after the interim deal is signed.

In the domestic sectors—like pharma, auto, textiles—push for careful protection amid proposed tariff cuts.

Despite challenges, both sides value a strategic partnership and are using direct leader and minister-level diplomacy to push forward.

An interim agreement by early July is likely to bring such measures as an outcome to remove or reduce the 26 per cent temporary US tariff on Indian exports. It also addresses lower cross-border duties and key non-tariff barriers.

Despite challenges, both sides value a strategic partnership and are using direct leader and minister-level diplomacy to push forward

In service, it covers selected service trade (e.g., digital) and commits to tariff stability going forward.

So, a comprehensive BTA will follow, resolving deeper issues in agriculture, auto, dairy, and pharma, with broader coverage by Fall 2025.

Final Take

India and the US are in a carefully calibrated give and take. India offers tariff reductions and regulatory easing across numerous sectors, while seeking strong protection for sensitive industries and a rollback of current and future US tariffs. The July 9 deadline is a critical pivot point, affecting whether the political urgency translates into a meaningful interim deal or a further escalation.

Manish Kumar Jha is a Consulting & Contributing Editor for SP's Aviation, SP's Land Forces and SP's Naval Forces and a security expert. He writes on national security, military technology, strategic affairs & policies.